San Francisco, the City by the Bay, is a beacon of culture, innovation, and breath-taking landscapes. However, the dream of owning a home here often clashes with the reality of the city’s competitive real estate market. But don’t let that deter you! This in-depth guide will arm you with essential knowledge and tools to successfully navigate the San Francisco housing market.

1. The Home Buying Process in San Francisco: A Step-by-Step Guide

Get Pre-Approved

Before you start your house hunt, it’s crucial to secure a pre-approval letter from a lender. This not only establishes your borrowing power but also strengthens your offer in the eyes of sellers. It’s a testament to your financial readiness and serious intent.

Partner with a Real Estate Agent

Next, find a real estate agent who has a deep understanding of the San Francisco market. Their expertise will be invaluable in finding properties that align with your budget, preferences, and long-term goals. They’ll also provide insights into the nuances of the local market that you might not find online.

House Hunting

With your agent’s guidance, start exploring potential homes. Attend open houses, schedule private viewings, and don’t forget to leverage virtual tours. Remember, buying a home is a significant investment, so take your time to find a place that feels right.

Make an Offer

Once you’ve found your dream home, your agent will help you craft a competitive offer. In San Francisco’s fast-paced market, be prepared to negotiate and potentially offer above the asking price.

Close the Deal

After your offer is accepted, the escrow process begins. This involves inspections, appraisals, and title work. Clear communication with your agent and lender is crucial during this stage to ensure a smooth closing.

2. Understanding Home Prices in San Francisco

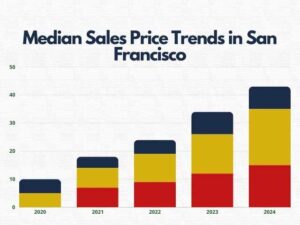

As of March 2024, the median listing price for a single-family home in San Francisco is around $1.3 million[realtor.com]. However, this figure can fluctuate significantly depending on the neighborhood, property type, and current market conditions. It’s essential to keep an eye on these trends to make an informed decision.

3. Discovering San Francisco’s Neighborhoods

San Francisco is a mosaic of diverse and distinct neighborhoods, each offering a unique lifestyle. Here are some factors to consider when choosing your ideal spot:

Family-Friendly Neighborhoods

If you’re looking for a family-friendly environment, consider neighborhoods like the Inner Sunset, Parkside, or the Outer Richmond. These areas offer spacious living, excellent schools, and a strong sense of community.

Urban Vibrancy

For those drawn to the energy of city life, the Mission District, SoMa, and Hayes Valley are vibrant neighborhoods with trendy restaurants, shops, and nightlife.

Tranquil Charm

If you prefer a quieter pace, consider Noe Valley, Cole Valley, or Laurel Heights. These neighborhoods are known for their tree-lined streets, charming Victorian homes, and a peaceful ambiance.

4. Essential Tips for First-Time Home Buyers in San Francisco

Save for a Down Payment

Aim to save a minimum of 20% for a down payment to avoid private mortgage insurance (PMI). This can significantly reduce your monthly mortgage payments.

Strengthen Your Credit Score

A higher credit score can lead to better loan terms and interest rates. It’s worth investing time to improve your credit score before applying for a mortgage.

Factor in Additional Costs

Remember to account for closing costs, property taxes, and homeowner’s insurance when determining your budget. These additional costs can add up and should be factored into your financial planning.

Get Educated

Familiarize yourself with San Francisco’s specific real estate market trends, regulations, and first-time homebuyer programs. Knowledge is power when it comes to making a significant investment like buying a home.

5. Financing Your Home Purchase in San Francisco

There are various financing options available to prospective homeowners:

Conventional Loans

These loans require a down payment and meet specific credit score and income requirements. They are a popular choice for many homebuyers.

FHA Loans

Backed by the Federal Housing Administration, FHA loans offer lower down payment options but come with mortgage insurance premiums. These loans can be a good option for first-time homebuyers or those with lower credit scores.

VA Loans

For veterans and eligible service members, VA loans offer zero down payment and competitive rates. These loans are a great benefit for those who have served our country.

Remember, buying a home in San Francisco is a journey. With the right preparation and guidance, you can navigate the city’s housing market and find a place to call home in the City by the Bay. Happy house hunting!