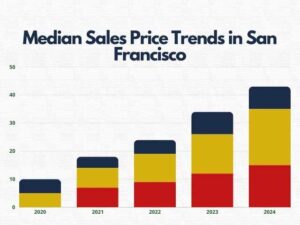

San Francisco’s housing market, a perennial darling (or villain depending on your perspective) in the national conversation, took an unexpected turn with the arrival of COVID-19. While many predicted a housing crash mirroring the empty office towers and deserted streets, the reality was a more nuanced story. Let’s delve deeper into the pandemic’s impact on San Francisco’s real estate, exploring how it affected different property types, how buyers and sellers adapted, and what the crystal ball shows for the post-pandemic future.

Pandemic’s Impact: A Temporary Dip, Not a Crash

The initial months of the pandemic were marked by a slowdown, as with most aspects of life. Shelter-in-place orders coupled with economic uncertainty caused a temporary pause in market activity. Transaction volumes dipped, with fewer buyers actively searching [Source: ZeroDown]. However, unlike national trends of plummeting prices, San Francisco’s median sale price held firm [Source: sf.citi]. This resilience can be attributed to two key factors: historically low interest rates that made borrowing more attractive and the tech industry’s strong performance fueled by the remote work revolution.

Changing Player Behaviour: Remote Work Reshapes Preferences

With commutes becoming a thing of the past for many, buyer priorities shifted dramatically. Home offices became a non-negotiable amenity, and access to outdoor space – a patch of green or a balcony for some fresh air – skyrocketed in demand. This newfound focus on functionality led to a surge in interest for single-family homes and larger condos, particularly in neighborhoods with a more suburban feel [Source: Kevin Ho]. Sellers, on the other hand, had to adapt their strategies. Traditional open houses, a staple of the pre-pandemic market, gave way to virtual tours and online presentations. This catered to a geographically dispersed buyer pool, with some potential buyers no longer limited by location constraints.

Post-Pandemic Forecast: Stability with a Slower Pace

Looking ahead, San Francisco’s real estate market is expected to remain stable. Experts predict continued growth, albeit at a more measured pace compared to the pre-pandemic boom [Source: Financial Samurai]. The city’s long-standing allure as a global innovation hub and center for the tech industry is unlikely to diminish. This enduring appeal, coupled with a limited housing supply, will continue to exert upward pressure on prices.

The Tale of Two Markets: Pandemic Winners and Losers

The pandemic exposed a clear preference for more spacious living. Single-family homes and condos with balconies or yards became hot commodities, experiencing a significant rise in demand. On the other hand, studio apartments and high-rise buildings in dense urban areas saw a lag in interest [Source: ZeroDown]. This trend reflects a temporary shift in priorities, with buyers prioritizing space and functionality over the hustle and bustle of downtown living.

A Safety Net: Relief Programs for Uncertain Times

The pandemic underscored the critical need for housing security. The city of San Francisco implemented various programs to assist homeowners and renters facing financial hardship. These included eviction moratoriums, rent relief programs, and mortgage forbearance options. These measures provided a vital safety net for many residents during a time of economic uncertainty.

By understanding the pandemic’s impact on San Francisco’s real estate market, you can navigate this dynamic landscape with greater confidence, whether you’re a seasoned investor, a first-time homebuyer, or simply someone keeping a curious eye on this ever-evolving market.