The way Americans buy and sell homes is undergoing a major shakeup due to a recent landmark legal settlement. This shift has the potential to significantly impact both buyers and sellers, making it crucial to understand the changes and navigate them strategically.

What Happened?

In late 2023, a massive antitrust lawsuit against the National Association of Realtors (NAR) resulted in a multi-billion dollar settlement. This settlement loosens the NAR’s grip on the housing market, particularly regarding realtor commissions, and is expected to take effect by July 2024, pending court approval. You can find more details about the lawsuit on the website of the Department of Justice.

What’s Changing?

The most significant changes revolve around realtor commissions, traditionally a fixed 6% of the sale price split between the buyer’s and seller’s agents. Here’s what you need to know:

- Goodbye Fixed Commissions: The standard 6% commission is no longer mandatory. Competition will now dictate agent fees, leading to potentially significant reductions. Estimates from industry experts suggest commission rates could drop by 25% to 50% depending on the market and individual negotiations [Source: National Association of Home Builders (NAHB).

- Negotiation is Key: Sellers can now shop around for better commission rates, interviewing multiple agents and choosing the one offering the most competitive service and fee structure. Similarly, buyers may need to negotiate their agent fees directly, ensuring they understand the services provided and the associated cost. Resources like Realtor.com or Zillow can help you connect with realtors in your area.

- Curbing Anti-Competitive Practices: The settlement prohibits certain tactics previously criticized as unfair, such as seller agents setting buyer agent compensation. This levels the playing field and empowers both buyers and sellers to negotiate more freely.

Potential Benefits

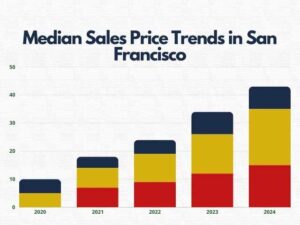

Lower Overall Costs: For homebuyers, the biggest win could be a significant decrease in the overall cost of buying a home. With potentially lower commission rates, buyers could save thousands of dollars, especially in high-value markets.

Potential Challenges

Shifting Payment Structures: Previously, many buyers financed the realtor commission within their mortgage. With the unbundling of commissions, buyers may need to pay their agents directly, which could be a challenge for those who haven’t factored this cost into their homebuying budget.

Rise of Unrepresented Buyers: The potential for lower fees might tempt some buyers to forgo using agents altogether. While this could save on commission costs, representing yourself in a real estate transaction can be complex and risky. Unrepresented buyers may struggle with tasks like property valuation, negotiation, navigating legal paperwork, and understanding market nuances.

Agent Exodus: The changes could lead to an exodus of some agents from the market, particularly those who relied heavily on the traditional commission structure. This could lead to a temporary shortage of experienced agents in certain areas.

The Bottom Line

This is a major shift in the real estate industry. While navigating the new landscape might require some adjustments, buyers could see substantial savings. However, it’s crucial to be aware of the potential challenges and do your research before entering the market. Here are some steps you can take to prepare:

- Educate Yourself: Familiarize yourself with the changes outlined in the settlement. Resources from the National Association of Realtors (NAR) or the Department of Justice can provide more details.

- Interview Multiple Agents: Don’t settle for the first agent you meet. Interview multiple realtors to understand their experience, expertise, and fee structure.

- Negotiate Fees: Don’t be afraid to negotiate your agent’s commission. Clearly outline the services you expect and ensure the fee reflects the value provided.

- Consider Represented vs. Unrepresented: Weigh the potential benefits and risks of going unrepresented. If you decide to forgo an agent, conduct thorough research and ensure you understand the complexities of the buying process.

By being informed and proactive, you can navigate the changing housing market and achieve your homeownership goals.