The San Francisco real estate market is one of the most vibrant and competitive markets in the world. With its iconic landmarks, booming tech industry, and breath-taking views, San Francisco has long been a sought-after location for real estate investment. In this blog post, we will explore the trends, prices, and affordable housing options in the San Francisco real estate market, providing expert insights based on years of experience in the industry.

History and Evolution of the San Francisco Housing Market

The San Francisco housing market boasts a rich and complex history, intertwined with the city’s growth and development. From the initial boom triggered by the Gold Rush to the recent tech-driven surge, understanding the historical context is crucial for deciphering current trends.

From Gold Rush to Earthquake: A City Takes Shape (1848 – 1906)

- The Gold Rush Boom (1848-1850s):The discovery of gold in 1848 ignited a massive influx of immigrants, propelling San Francisco’s population from a mere 1,000 to over 25,000 in just two years. This rapid growth spurred the construction of hastily built housing, primarily single-family homes and boarding houses.

- Early Regulation and Segregation (1870s):As the city expanded, concerns about overcrowding and sanitation led to the implementation of the first housing regulations, such as the Cubic Air Ordinance of 1870. However, these regulations were often discriminatory, disproportionately targeting specific ethnic groups like the Chinese community.

- The 1906 Earthquake and Fire: The devastating earthquake and fire of 1906 destroyed over 30,000 buildings, displacing tens of thousands of residents. The reconstruction efforts emphasized fire safety and earthquake resistance, shaping the architectural landscape of the city.

Post-Earthquake Growth and Suburbanization (1906 – 1940s)

- Rebuilding and Regulation: Following the earthquake, stricter building codes emerged, influencing the construction of sturdier, multi-unit structures. Rent control was also introduced in 1917, becoming one of the first such policies in the nation.

- The Rise of Suburbs: The development of the Golden Gate Bridge in 1937 and the expansion of transportation infrastructure facilitated suburbanization. This led to a decline in the population density of the city centre as residents sought larger homes and more affordable housing options in surrounding areas.

Post-War Boom and Challenges (1940s – 1980s)

- Post-WWII Housing Boom: The post-war economic boom and the influx of returning veterans from World War II fuelled another surge in housing demand. This period saw the construction of large-scale public housing projects and single-family homes in newly developed suburbs.

- Redlining and Urban Renewal: Unfortunately, discriminatory practices like “redlining” by banks and lenders disproportionately denied mortgages to residents in minority neighborhoods, hindering their ability to achieve homeownership and perpetuating racial segregation in housing.

- The 1989 Loma Prieto Earthquake: The 1989 earthquake exposed vulnerabilities in older buildings, leading to stricter seismic retrofitting regulations and impacting the housing market in affected areas.

The Tech Boom and Beyond (1990s – Present)

- The Dot-Com Boom (1990s):The rise of the tech industry in the late 1990s, fuelled by the dot-com boom, attracted a large influx of highly-paid workers to San Francisco and the surrounding Bay Area. This surge in demand significantly outpaced the available housing supply, leading to rapid price increases and increasing concerns about affordability.

- The Great Recession (2008):The nationwide economic downturn of 2008 negatively impacted the San Francisco housing market, causing a temporary decline in housing prices and foreclosures. However, the market recovered relatively quickly due to the continued strength of the tech sector.

- The Continued Housing Crisis (Present):Despite economic growth, the San Francisco Bay Area continues to grapple with a significant housing crisis. The limited supply, coupled with ongoing demand from the tech industry and other sectors, has pushed housing prices to record highs, making it increasingly difficult for many residents to afford to live in the city.

Understanding the historical context of the San Francisco housing market is essential for analysing current trends and formulating effective solutions to address the ongoing challenges of affordability, gentrification, and equitable housing access.

Navigating the Complexities: Factors Shaping San Francisco Real Estate

The San Francisco real estate market is a dynamic landscape influenced by a multitude of factors. Understanding these forces is crucial for anyone considering buying, selling, or investing in the city.

Supply and Demand: The primary driver of San Francisco’s housing market is the stark imbalance between supply and demand. The limited availability of new housing units, particularly affordable options, cannot keep pace with the high demand fuelled by factors like job growth and migration. This imbalance has pushed real estate prices to record highs, making San Francisco one of the most expensive housing markets in the nation.

Economic Conditions: Beyond supply and demand, the broader economic picture plays a significant role. Job growth in the tech sector and other industries attracts a highly-paid workforce that can afford San Francisco’s high housing costs. However, income inequality leaves many residents struggling to keep up with rising rents and property values.

Government Policies: Finally, government policies such as zoning regulations and tax incentives also shape the market. Zoning regulations can limit the construction of new housing units, further impacting supply. Conversely, tax breaks for developers or first-time homebuyers can encourage investment and potentially increase affordability.

By understanding these complex and interconnected factors, individuals can make informed decisions when navigating the ever-evolving San Francisco real estate market.

San Francisco Real Estate: A Market in Flux

The San Francisco real estate market currently stands at a crossroads, characterized by skyrocketing prices and limited inventory, but also facing growing concerns about affordability and housing availability.

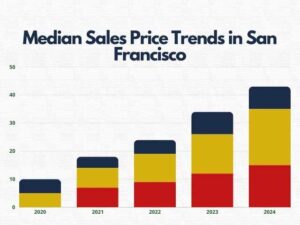

Price Surge: As of January 2024, the median sale price of a single-family home in San Francisco reached a staggering $1.3 million, representing a 7.6% year-over-year increase [Source: Redfin]. This makes San Francisco one of the most expensive housing markets in the United States.

Demand Outpaces Supply: The demand for housing continues to outstrip supply. In January 2024, there were only 218 homes sold, compared to 207 the previous year, highlighting the limited availability [Source: Redfin]. This imbalance fuels fierce competition among buyers, with homes often receiving multiple offers and selling above asking price [Source: Redfin].

Challenges and Initiatives: Despite the strong market performance, significant challenges loom. The housing shortage continues to be a major concern, pushing affordability out of reach for many residents. To address this, various initiatives are underway, including zoning reforms and the development of more affordable housing options.

Overall, the San Francisco real estate market presents a complex picture. While high prices and strong demand offer opportunities for sellers and investors, affordability concerns and the need for increased supply remain critical issues to watch in the coming years.

Homes Fit for the Affluent: San Francisco’s Priciest Neighborhoods

San Francisco boasts a diverse landscape, and this extends to its real estate market. While affordability remains a major challenge, the city also features exclusive neighborhoods catering to the most discerning and well-heeled buyers.

Pacific Heights: Nestled atop a hill overlooking the bay, Pacific Heights is renowned for its grand Victorian mansions, charming tree-lined streets, and breath-taking views. The median sale price for a single-family home in Pacific Heights currently sits around a staggering $5.2 million, making it one of the most expensive neighborhoods not just in San Francisco, but in the entire nation [Source: Local MLS data].

Russian Hill: This historic and picturesque neighborhood offers a unique blend of charming Edwardian architecture, vibrant nightlife, and close proximity to iconic landmarks like Lombard Street. The median sale price for a single-family home in Russian Hill is no less impressive, hovering around $4.8 million [Source: Local MLS data].

Nob Hill: Characterized by its cable car lines, luxurious hotels, and iconic landmarks like Grace Cathedral, Nob Hill exudes an air of grandeur and sophistication. Homes in this sought-after neighborhood come with a hefty price tag, with the median sale price for a single-family home reaching approximately $4.5 million [Source: Local MLS data].

While these neighborhoods offer unparalleled luxury, exclusivity, and prestige, it’s important to acknowledge the significant financial barrier they present. The sky-high prices in these areas make them out of reach for most buyers, highlighting the stark contrast within the San Francisco housing market.

Finding Your Place: Affordable Housing Options in San Francisco

San Francisco, with its vibrant culture and booming job market, can be a challenging place to find affordable housing. However, there are still options available for those willing to explore and be flexible. Here’s a breakdown of some potential solutions:

- Affordable Housing Programs:

- Income-restricted apartments: These apartments have rent limits based on the tenant’s income, typically capped at a percentage of the Area Median Income (AMI). The San Francisco Mayor’s Office of Housing and Community Development (MOHCD) offers a comprehensive list of available affordable housing opportunities, including income-restricted apartments, on their website .

- Inclusionary zoning: This policy requires developers to set aside a certain percentage of units in new developments for below-market rents. Be sure to inquire about inclusionary units when considering new apartment buildings.

- Co-living Arrangements:

- Shared housing: Sharing an apartment or house with roommates can significantly reduce housing costs. Platforms like Craigslist, Facebook Marketplace, and dedicated co-living companies can help connect potential roommates.

- Micro-units: These small, studio-style apartments offer a more affordable option compared to traditional apartments, particularly in high-demand areas. However, availability can be limited.

-

Exploring More Affordable Neighborhoods:

While San Francisco’s overall housing market is expensive, some neighborhoods tend to be more affordable than others. As of February 2024, these neighborhoods offer median rent for a one-bedroom apartment below the citywide average of $3,200.

- Excelsior: Median rent – $2,500

- Outer Mission: Median rent – $2,800

- Ingleside: Median rent – $2,600

- Richmond District: Median rent – $2,700

- Sunset District: Median rent – $2,900

Remember:

- Availability and pricing can change quickly. So, it’s crucial to conduct thorough research and stay updated on the latest listings.

- Be prepared for competition, especially when applying for affordable housing programs or units in highly sought-after neighborhoods.

- Consider transportation costs when evaluating affordability. While some neighborhoods may offer lower rents, they might be farther from job centers or require relying on public transportation, which adds to monthly expenses.

Finding affordable housing in San Francisco requires effort, flexibility, and resourcefulness. By exploring the options listed above and conducting thorough research, individuals and families can increase their chances of finding a suitable and budget-friendly place to call home in this dynamic city.

San Francisco’s Balancing Act: Weighing Opportunities and Risks by Neighborhood

San Francisco offers a vibrant mix of cultural attractions, job opportunities, and stunning scenery. However, the city also grapples with varying crime rates across different neighborhoods. Here’s a breakdown to help you navigate the opportunities and risks:

Areas with High Opportunities, Lower Crime:

- Inner Richmond/Sunset District: Primarily known for its family-friendly atmosphere, these areas boast excellent public schools, quiet streets, and access to Golden Gate Park. While not immune to crime entirely, they generally experience lower rates compared to the city centre.

- Outer Mission: This Latino cultural hub offers a vibrant community, delicious restaurants, and relatively affordable housing options. Crime rates are lower here compared to some central areas, but property crime can still be a concern.

- Noe Valley: This charming and walkable neighborhood features trendy shops, cafes, and a strong sense of community. Crime rates are generally considered moderate.

Areas with High Opportunities, Higher Crime:

- SOMA (South of Market):A hub for tech start-ups, trendy restaurants, and nightlife, SOMA offers exciting career prospects. However, property crime, particularly car break-ins, can be a concern in some areas.

- Financial District: The heart of San Francisco’s financial sector, this area offers abundant job opportunities and a central location. However, street crime can be higher here, especially during evening hours.

- Union Square: A renowned shopping and tourist destination, Union Square boasts upscale stores, art galleries, and a bustling atmosphere. However, petty theft and pickpocketing can be issues, particularly for tourists.

Areas with Lower Opportunities, Lower Crime:

- Excelsior/Ingleside: These neighborhoods offer a more suburban feel with single-family homes and quiet streets. While housing costs might be slightly lower compared to the city center, job opportunities can be more limited. Crime rates are generally lower in these areas.

Important Considerations:

- Crime rates can vary within neighborhoods, so it’s crucial to research specific areas you’re interested in. Utilize resources like https://sfgov.org/services/sf-crime-mapsto get a more granular view.

- Remember, “safe” and “affordable” are subjective terms.

- Consider your personal risk tolerance and lifestyle preferences when evaluating opportunities and risks.